No matter what your city's rental situation looks like, it has a lot of incentive to stabilize prices as soon as possible.

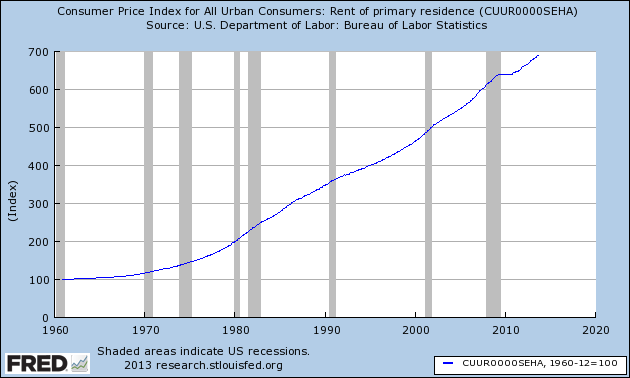

Home prices, like rents, have been on an upward trajectory for decades, but as we know from the recent financial crash, owned homes have fluctuated wildly. Rentals haven't: they've increased consistently for the past fifty years, and even when they've been relatively flat in certain markets, they've very rarely decreased. A graph of the nationwide rent price index shows a steady, consistent rise since 1960:

The fact that rents increase is obvious, but that they almost never decrease has serious implications. Specifically, it means that the longer your city waits to seriously address its affordability problems, the worse they'll become. And when (or if) your city

does

manage to get rental prices under control, they're probably going to remain at those high prices even if they don't continue to climb. San Francisco will never be cheaper than it is now, nor will New York, D.C., L.A., or just about anywhere else.

A big part of the reason prices don't go down, I think, is that market rate rents determine what a property owner will seek from a potential buyer. If I've got a developable plot of land downtown, I'm going to ask a lot more for it if I know the units built on it will rent for $3,500 a month instead of $1,400. The cost of that land then contributes to the

need

for developers to charge $3,500 a month in order to earn a profit. Or you can think of it as the developer being willing to pay more because they can command a higher rent, the point remains the same. It also means that the higher we let property values climb, the more money cities and non-profits need to spend on land for affordable housing development, regardless of what they plan to charge for rent.

I suspect many people will read this and think, "well, obviously," but our actions aren't reflective of how serious a problem this is. Despite how much talk there is of "affordability" from media, politicians, and advocates, we're still doing almost nothing to solve the problem. We're so concerned with gentrification, parochial interests like parking, and the idea of developers earning a profit that we've paralyzed ourselves. We whine and talk about things like rent control and inclusionary zoning despite the fact that they've done nothing to limit prices overall, and we appear unwilling to pay the cost of building and subsidizing the millions of units it would take to actually satisfy demand across the country.

Rent control in particular is not a long term solution because it does nothing to increase the stock of much-needed rental housing in cities, and I plan to discuss alternatives to that in an upcoming post. For now, suffice it to say that allowing more construction has to be a part of the solution. As I wrote back at the start of this blog,

. Where development has actually been embraced to some degree,

developers themselves have openly worried about overbuilding and rents decreasing

. We should learn from their expertise and let them build enough that they have to fight over tenants, not pick from the cream of the crop. The longer we wait the worse things will get, and the more costly it will be—permanently—for cities to ensure that low- and moderate-income residents can continue to live in the cities where they work.

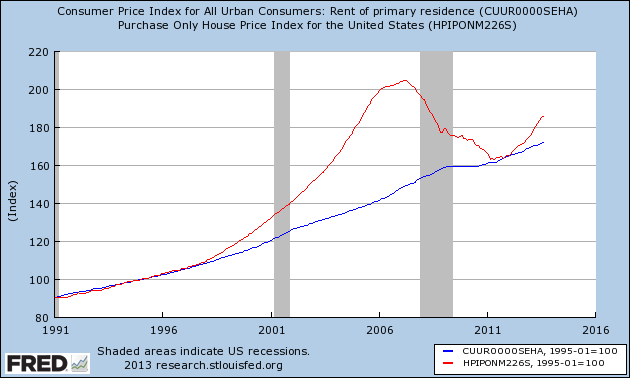

If you're interested, there are some graphs of rent vs home price indices in various cities below.

United States:

New York:

Los Angeles:

Chicago:

San Francisco:

Boston:

Seattle:

Atlanta:

Detroit: