It's a common refrain among urbanist types who are savvy to land use issues that increasing the amount of housing in a region can lower rents, or at least slow their rise. The reasoning is straightforward: if you have more demand than supply, prices will increase; if you increase supply to meet or exceed demand, landlords will be forced to compete with one another for renters and prices will decline.

This sounds really great. When you combine it with all the other great things densely-built, transit-oriented development can bring (more walking, bicycling, and transit use; more efficient use of energy and infrastructure; greater diversity of shops, restaurants, and entertainment; more spontaneous interactions with other members of the community; etc.), it sounds even better. But is it true? Do rents really decline just because more units of housing get built? I wanted proof.

After reading this article at the Seattle Times on the boom in apartment building in the Puget Sound region and the effects it may have on rents, I felt like I was on the right track. Unfortunately, the most conclusive statement contained in the article in support of this idea was the following:

[T]he regional apartment-vacancy rate has stopped dropping, both Dupre + Scott and Apartment Insights say, and it should start inching up next year as a bumper crop of new apartment projects comes to market.

That means “rents will basically have to flatten out,” said Mike Scott of Dupre + Scott.

Great news! Not exactly a scientific proof, but I'll take it. Near the end of the article, however:

Even so, 73 percent of landlords responding to that company’s survey said they plan to increase rents over the next six months.

Okay, not so good news. Most of the 35,000 units planned for the next 5 years haven't opened yet though, so maybe landlords are just getting what they can while the gettin's good. Soon enough, the thinking goes, the balance of power is going to tip back toward the renters, and prices will moderate. And a good thing too, since in-city rents for 20+ unit apartments in Seattle have increased by almost 7.5% in the last year (most of that, 6%, in the last 6 months). Has this actually happened? Thankfully, the Times article led me to the answer.

In an article Dupre + Scott Apartment Advisors have produced to accompany the aforementioned survey, they clearly describe some of the trends in the region and break it down into sub-regions with some nice charts. I really encourage you to read the whole thing--it's not too long. But first, and most importantly, I'd like to show you the following two charts from the article:

What I hope you'll appreciate when looking at these charts is their opposing nature. When vacancies are low, rents go up; when vacancies are high, rents go down. That's right, they actually went down! Next time someone tells you it's not possible, and asks you how building new, usually more expensive housing will lower rents, just point them here. It works. And just to be clear, I believe these prices are in nominal terms, not inflation-adjusted, which would explain why prices tend to increase by higher percentages than they decrease. If you provide enough housing to affect vacancies (i.e., enough to meet or exceed demand), prices will go down.

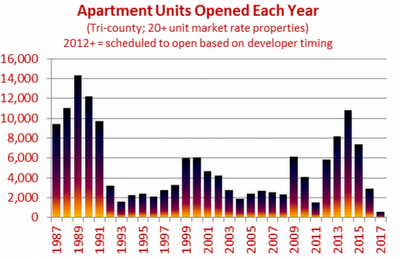

Now I'd like to point out one more chart:

Note how many apartment units were opened in 1999-2002, and then take a look at the vacancy rate for 2001-2005 in the earlier chart. We built a lot of units in that time period, and it seems that this had a significant impact on the market vacancy rate. If you know of something else that accounted for this difference please let me know in comments, but for now I'm going to stick with the sensible conclusion that the supply increased beyond demand and we ended up with a bit of an apartment glut. Prices went down and all was right with the world (for renters, at least). Now look at how many units are planned for 2012-2015. Many more! I suspect that demand for urban living has increased since the early 2000s, but nonetheless this bodes very well for apartment prices in the coming years. And just to drive the point home, note that it took a year or two after the apartments started coming online for prices to start declining. That shouldn't be surprising since the first to open probably only served to soak up the existing unsatisfied demand for living in the regions--it took an excess of supply to actually start bringing prices down.

One more thing to look forward to, renters: besides the large addition of apartments we're experiencing, the real estate market is also improving. That means many people who were forced into renting, or delayed buying a house until they were certain the real estate market had hit rock bottom, are going to start exiting the rental market. So look for this to remove some of your competition as well, driving prices down even further.

So three cheers for providing more housing in Seattle! It's efficient, it's in demand, and it helps keep housing affordable. What's not to like!?